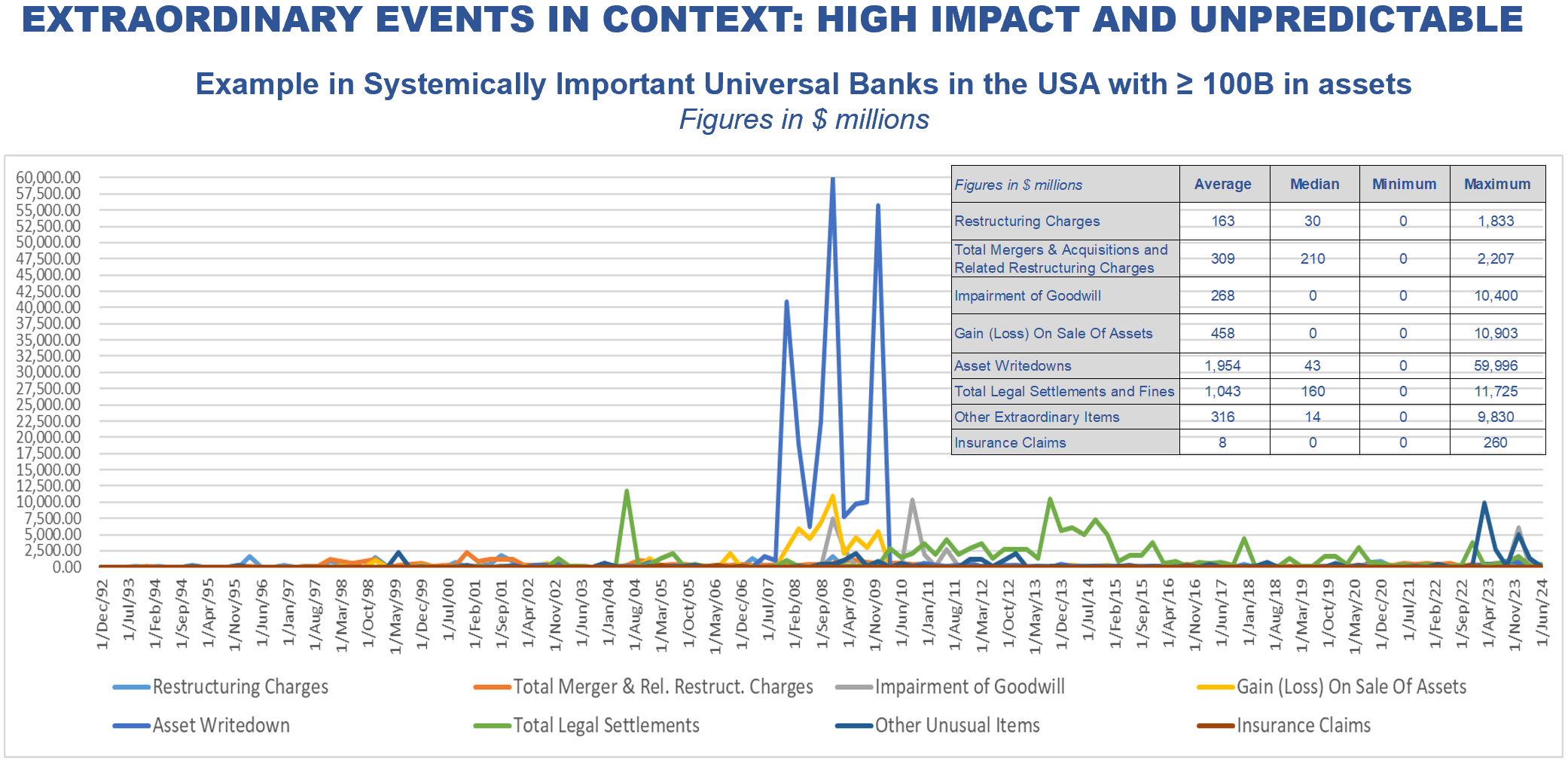

Marginal AI is a specialized tool for tracking extraordinary events that fall outside the routine scope of business operations for U.S. corporations. These events - such as litigation, regulatory actions, insurance claims, new legislation, cyber-attacks, contingent liabilities, pandemics, mergers & acquisitions, macroeconomic shifts, and over four hundred more - can have a significant impact on businesses yet remain unpredictable and difficult to track.

Marginal AI provides fast, seamless access to crucial event-driven information, broadening coverage in one centralized platform - without the need for coding, manual workflows, and at a relatively low cost.

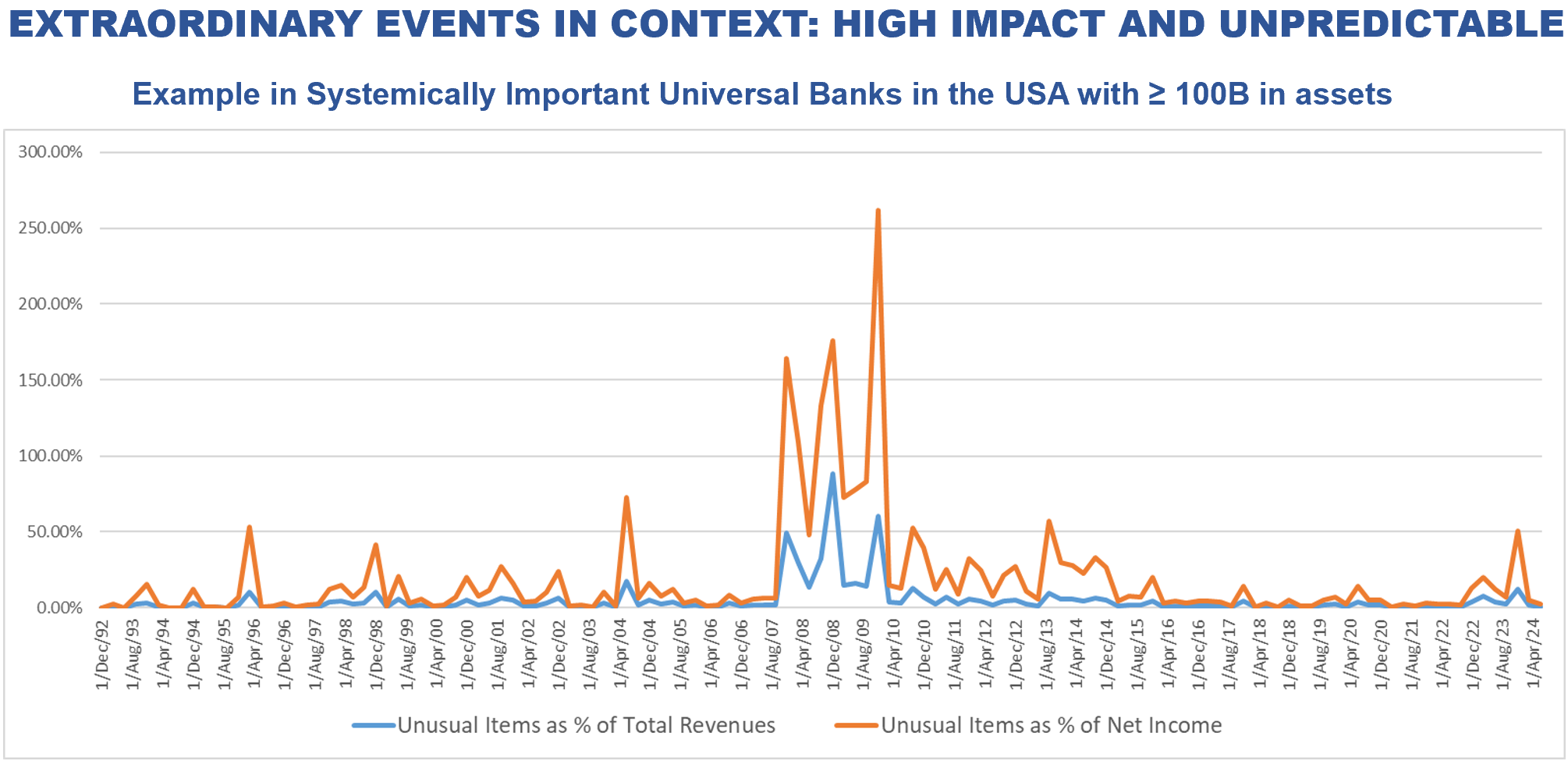

Extraordinary Events Are Unpredictable, Non-Recurring, and High-Impact - Stay Ahead with Proactive Tracking

Unpredictable: These events occur without warning, making proactive tracking essential.

Non-Recurring : Unlike operational business cycles, extraordinary events do not follow patterns.

High Impact: When they happen, they can significantly alter a company’s or industry’s trajectory.

Whether you’re operating in private or public markets, tracking extraordinary events that impact publicly listed U.S. corporations is essential for:

Marginal AI: The Smarter Way to Track Extraordinary Events